FairShare: Rethinking Shared Finance Through Social Design

Mixed-Method UX Research

Wireframing

Prototyping

0→1 Design

Overview

FairShare is a social-fintech app that makes sharing money with friends simple, fair, and fun. It reimagines group expense management by blending Splitwise-style functionality with social and gamified interactions. Users can automatically split bills, save collectively for shared goals, send friendly reminders, and celebrate milestones — all while maintaining transparency and harmony in their relationships.

My Role

Primary Designer/Researcher

Team

-

Timeline

8-10 Weeks

Tools Used

Figma/Miro

Notion/Google Docs

Lookback

Relume.io/v0

The Problem

Splitting money among friends sounds simple.

In reality, it’s anything but.

People regularly share expenses for:

Trips

Rent and utilities

Group dinners

Gifts and celebrations

Yet money introduces tension:

Asking someone to pay feels awkward

Reminders feel confrontational

Transparency can feel like oversharing

Existing apps feel cold, transactional, or invasive

Most tools solve the math.

Very few solve the social friction.

Why This Problem Matters

Research and industry patterns show that:

Money is one of the most emotionally charged topics in friendships

Users often avoid follow-ups to “keep the peace”

Public financial feeds increase discomfort rather than trust

People rely on multiple apps to manage one shared experience

Despite the popularity of finance apps, no tool meaningfully supports the emotional side of shared money.

Design Goal

How might we help people manage shared expenses and group financial goals in a way that feels transparent, motivating, and socially safe—without damaging relationships?

Understanding the User & Early Assumptions (Why They Were Wrong)

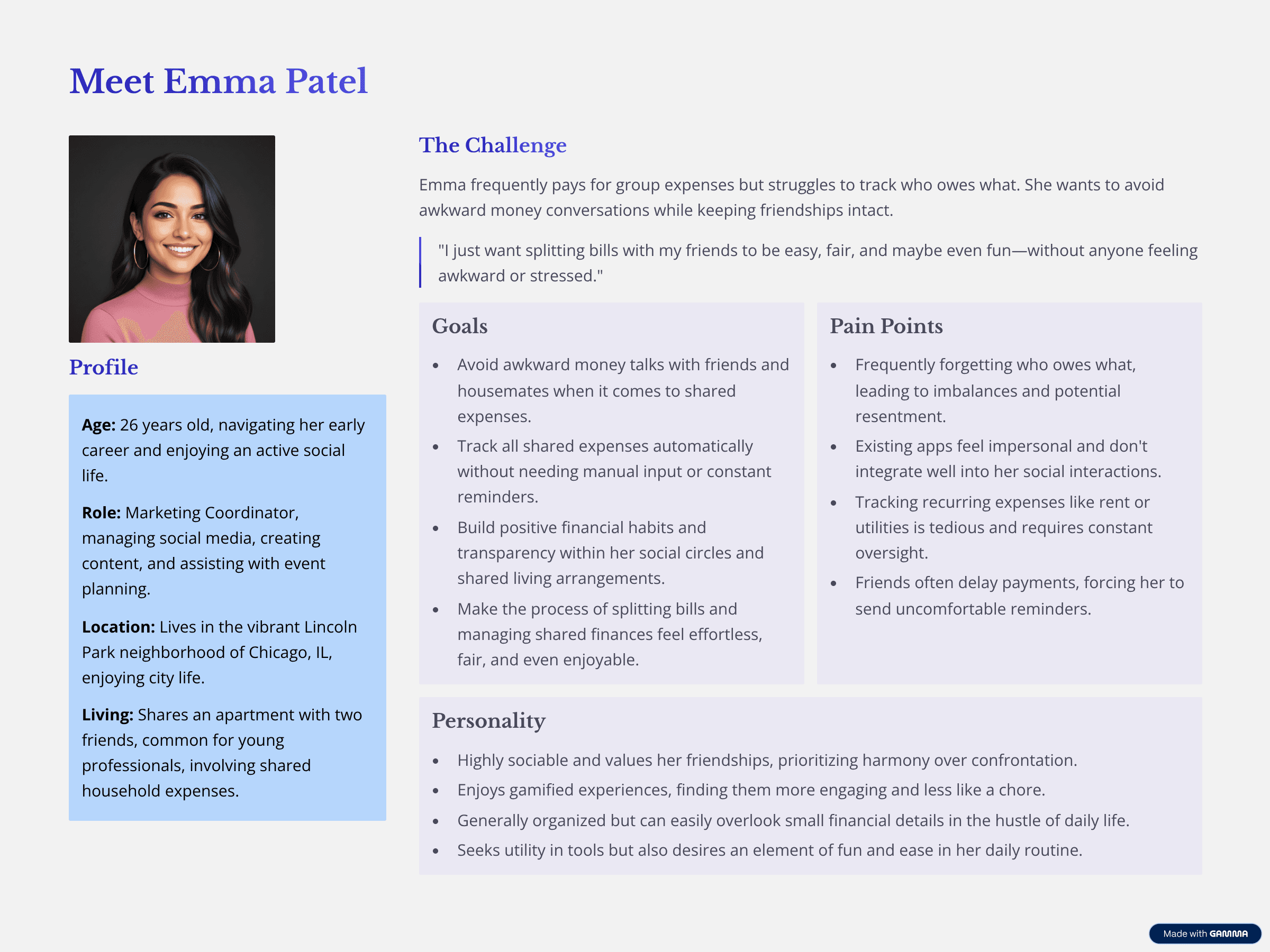

Primary Persona: Emma

Initially, I assumed:

Automatic activity updates would be helpful

Transparency meant visibility by default

Social feeds would naturally increase engagement

User research quickly challenged these assumptions.

Research & Discovery

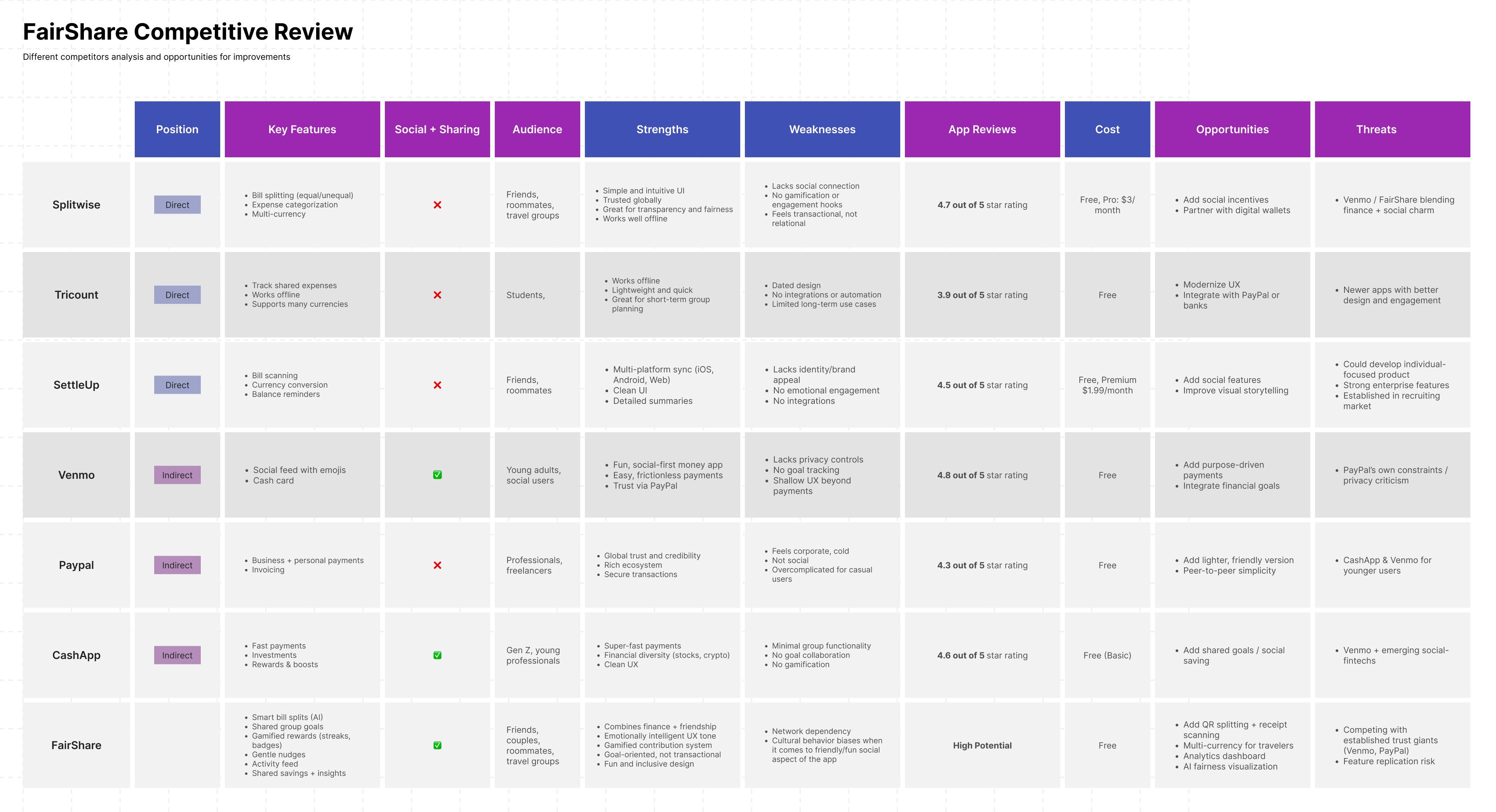

Method 1: Competitive Analysis

Apps Reviewed:

Splitwise

Tricount

SettleUp

Venmo

PayPal

CashApp

What I Studied:

Expense splitting flows

Privacy models

Social features

Motivation mechanics

Key Findings

Apps focus on either finance or social, rarely both

Public-by-default feeds cause discomfort

No app allows users to manually curate financial updates

Gamification and goal motivation are largely absent

Opportunity Identified:

Design a social-finance experience where users control visibility, and progress feels shared—not exposed.

Method 2: Design Review & User Testing

Participants: 4 users with UX familiarity and real experience using finance apps

Goals:

Evaluate the interpretation of social-finance features

Test navigation and core tasks

Understand comfort around sharing financial activity

Tasks Tested:

Create a shared goal

Add a contribution

Split a bill

Interpret the activity feed

Adjust privacy settings

Scenarios Used:

Saving for a “Trip to Japan”

Splitting a group dinner bill

What Users Told Me (Directly)

“I don’t want the app announcing what I did.”

“The feed feels generic—where’s the personalization?”

“I’m hesitant to share financial activity publicly.”

“I’m not sure what happens after I contribute.”

These comments reshaped the entire product direction.

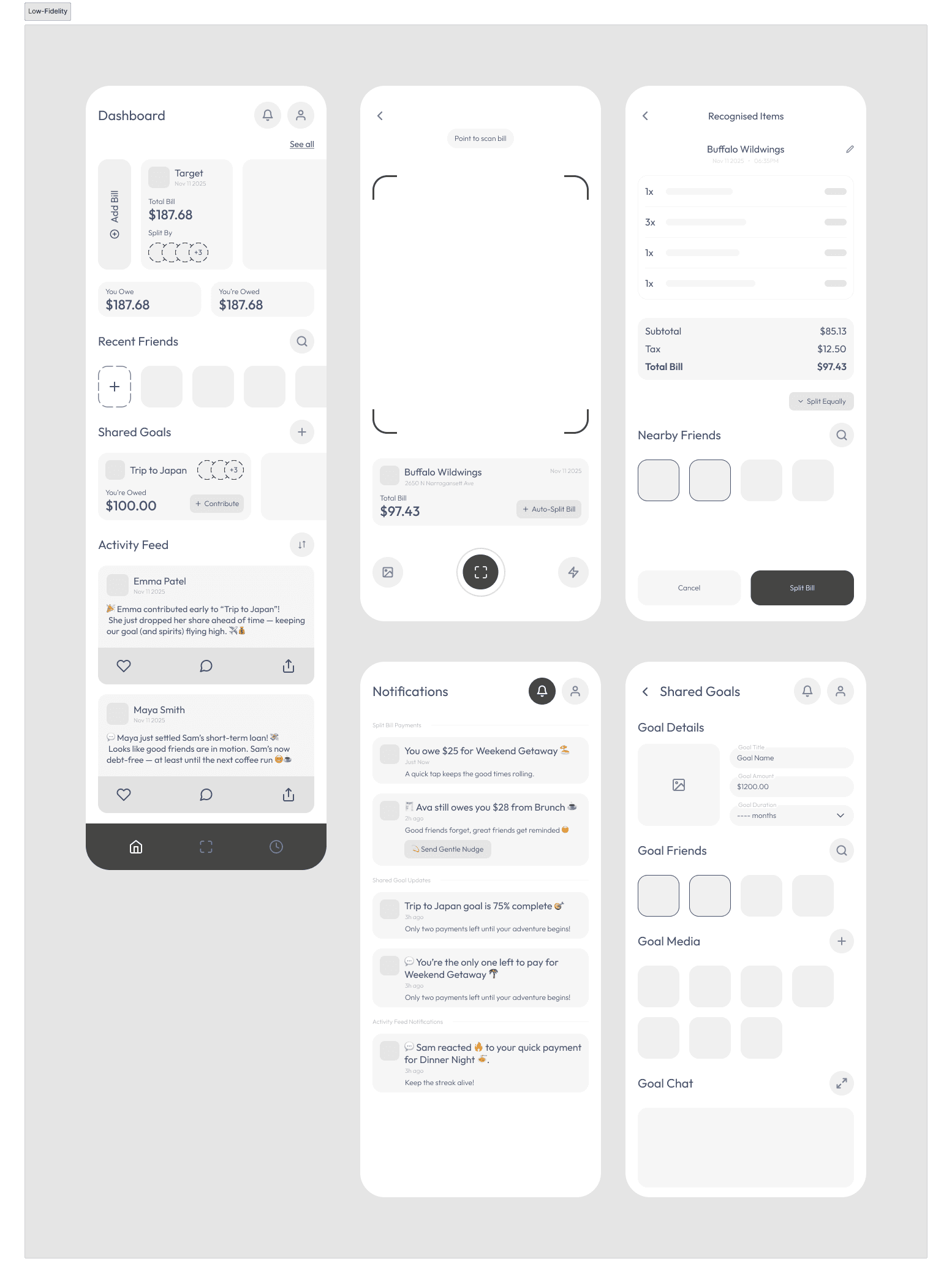

Low-Fidelity Exploration

I began with rough sketches focused on:

Dashboard-first navigation

Quick bill scanning

Shared goal visibility

Automatic activity feed

Early Structure:

Dashboard

History

Scan Bill

Chat

What Didn’t Work

Automatic feed posts felt invasive

Goal creation and chat felt blended

Contribution outcomes weren’t clear

Privacy controls were missing

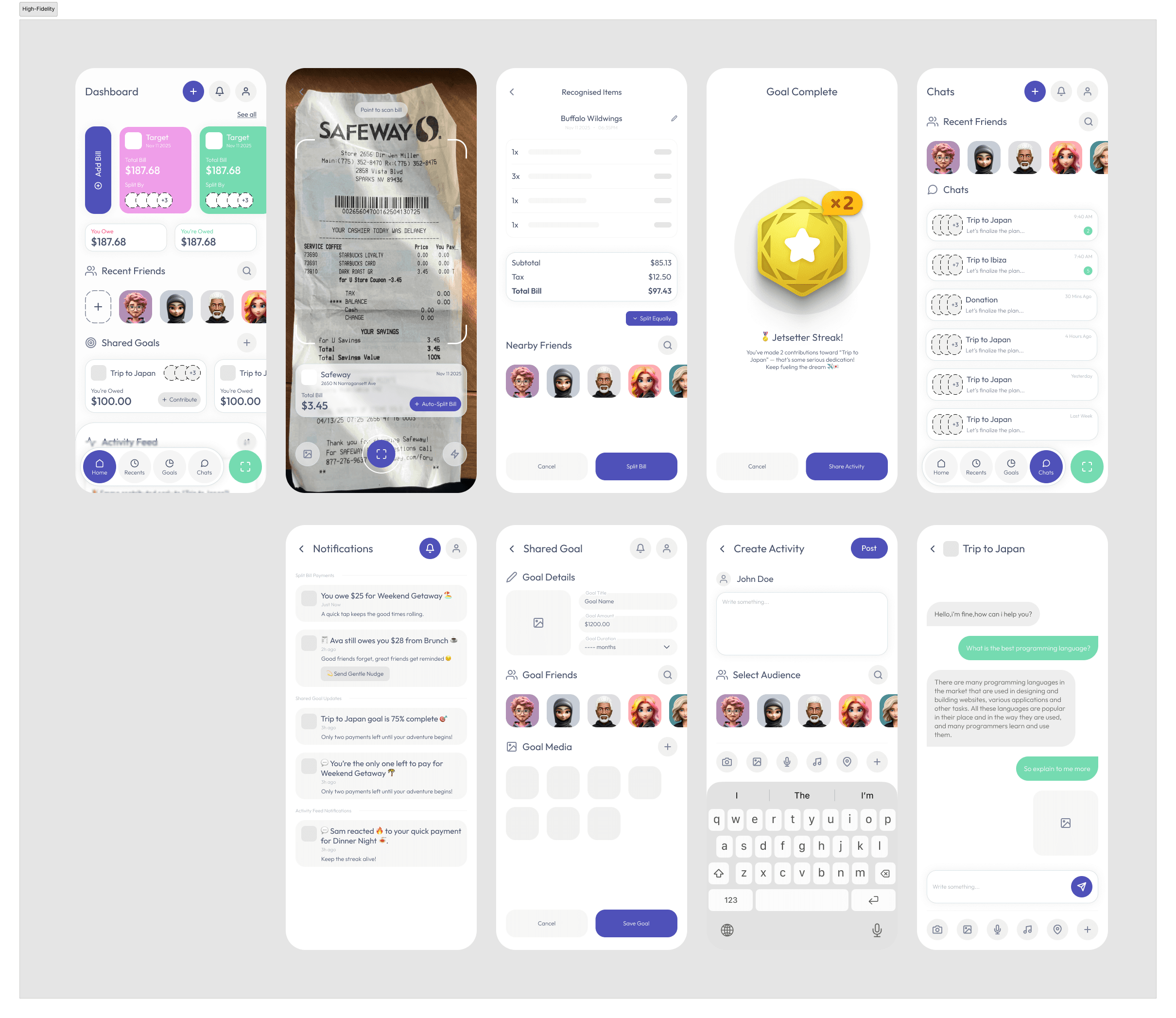

Design Iteration: From Lo-Fi to Hi-Fi

User feedback led to major structural changes.

Key Improvements

1. Manual Activity Creation

Instead of auto-generated posts, users now:

Choose when to share

Write their own updates

Control visibility per post

This restored a sense of ownership and trust.

2. Privacy as a First-Class Feature

Every action includes:

Audience selection

Private / group-only / visible options

Privacy moved from a setting to a design principle.

3. Milestone Gamification

Users wanted motivation—not pressure.

Added:

Contribution badges

Group milestones

Progress celebrations

These reinforced teamwork without competition.

4. Clear Separation of Spaces

Goal creation

Goal overview

Group chat

Each now serves a distinct mental model, reducing confusion.

High Fidelity Screens

The Final Experience

Core Features

Smart bill splitting

Shared financial goals

Manual social updates

Privacy-first activity feed

Milestone-based motivation

The experience feels:

Supportive

Transparent

Social—but never invasive

Why This Works

FairShare doesn’t just track money.

It protects relationships.

By respecting emotional boundaries, offering control, and celebrating progress collaboratively, FairShare reframes finance as a shared experience—not a source of tension.

Other

Projects

FairShare: Rethinking Shared Finance Through Social Design

Figma/Miro

Notion/Google Docs

FairShare is a social-fintech app that makes sharing money with friends simple, fair, and fun. It reimagines group expense management by blending Splitwise-style functionality with social and gamified interactions. Users can automatically split bills, save collectively for shared goals, send friendly reminders, and celebrate milestones — all while maintaining transparency and harmony in their relationships.

View Project

JobSync: Designing a Focused, Privacy-First Job Search Experience

Figma

Miro/FigJam

JobSync is a conceptual browser extension and dashboard designed to help job seekers manage their applications, follow-ups, and insights in one focused, privacy-conscious space. The project explored how thoughtful UX, supported by AI, can reduce cognitive load during the job search without overwhelming users or compromising trust.

This case study documents a 0→1 design process, from early assumptions and user research to iterative prototyping, usability testing, and refinement. The goal was not to introduce more automation, but to design clarity into a complex, emotionally charged workflow.

View Project

Chirp: Hyper-Local Social Platform for Connected Neighborhoods

Figma/Figjam

Miro

Chirp is a concept project addressing the lack of safe, relevant digital spaces for neighborhood communication. Research showed that existing platforms often feel noisy or unmoderated, discouraging trust and participation. We chose this problem to explore how UX could enable meaningful local engagement without overwhelming users. The solution focused on a lightweight, community-first platform that prioritizes relevance, safety, and user control. Through user interviews, focused use cases, and iterative prototyping with usability testing, we designed an experience that helps neighbors share updates, discover local information, and engage confidently within their community.

View Project